Digital must become the default for supply chains

Two weeks ago I was interviewed for Tradeshift's quarterly report 'Index of Global Trade Health". Below is a transcript of this interview. If you want to read the 10 page report it is available here for free.

Q&A with Rob van Ipenburg, Managing Partner, Quyntess

What characteristics of modern supply chains make them vulnerable to the kind of volatility we’ve seen over the past year?

Most manufacturers are heavily reliant on labour, so lockdown restrictions had a significant impact when many factories were forced to close. Demand from OEMs dropped off. On the supply side the same thing happened and this made materials sourcing even more challenging.

Market forces dictate that modern supply chains are often long and complex. Longer supply chains tend to magnify the impact of disruption, but companies with more distributed supply chains can also absorb fluctuations more easily. In some cases that might mean a company invests in diverse sourcing options. It’s also increasingly common for companies to invest in facilities with more flexibility to produce different products in stead of concentrating all volume in one site for economies of scale. For CPG companies, where this approach is now fairly common, fluctuation levels were around 10%, whereas in the industrial sector where distributed supply chains are less common, fluctuations could run up to 80% above typical levels. The higher the level of fluctuation, the more pressure that exerts on the supply chain.

Lockdowns are easing and economies seem to be opening up. But the situation across supply chains still seems volatile. Is that something you’re seeing?

Demand from OEMs is very strong, with the exception of automotive and aerospace. What we’re seeing right now is partially a catch-up from missed sales in 2020 and the first quarter of 2021 and there are some pretty strong V-shaped recoveries. On the supply side, instability is still high with significant shortages of key parts. And while order volumes are back up are fluctuating at around three times the normal level, with order volumes being revised several times from when the order is issued and when the material is shipped.

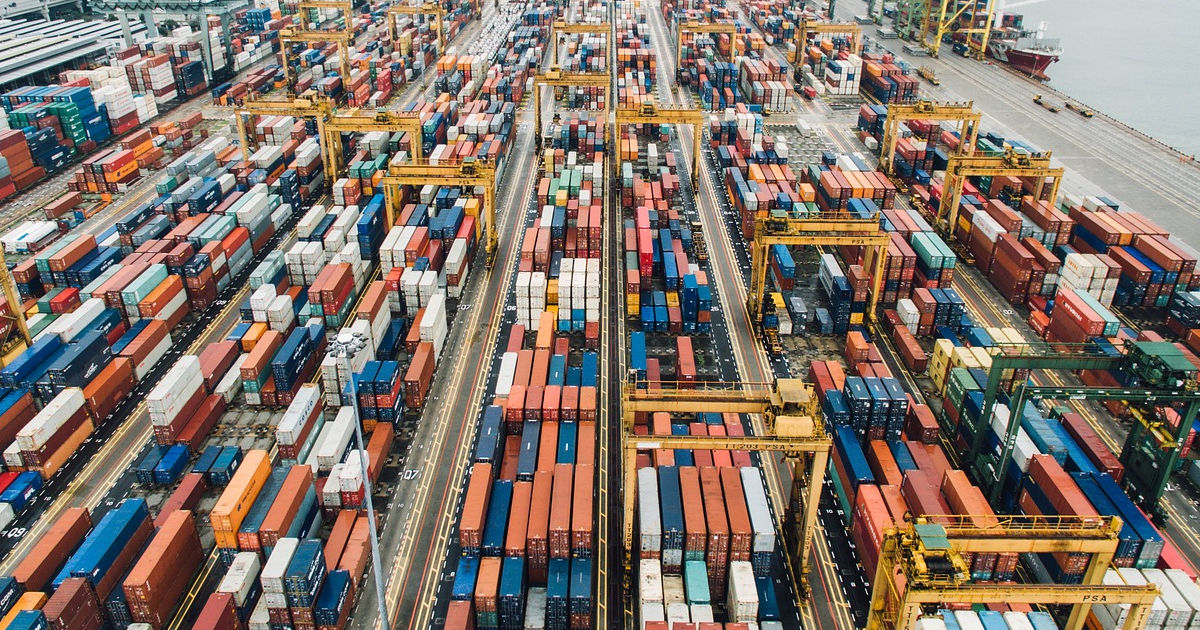

The shortage of ocean transport is also causing a lot of unpredictability when it comes to the physical movement of goods. Even when materials are dispatched from a supplier there are no guarantees it will arrive on schedule. That triangle of collaboration between the supplier, logistics service provider and buyer is far more important right now than it might have been previously when there was plenty of spare logistics capacity.

There are some fairly radical opinions being shared about how to build resilience across supply chains. How dramatic are the changes we’ll see to supply chains likely to be post-COVID?

Industries like aerospace and automotive simply would not have room at their sites to move away from just-in-time manufacturing systems. A lot of businesses are looking towards multi-sourcing and distributed supply chain models however. Transitions like this are more subtle, but they also demand far more collaboration across the supply chain as organizations look to spread demand across a number of different suppliers and locations.

Experiences of the past year have flipped the conversation around resilience. Whereas before companies based decisions primarily on cost, they’re beginning to ask questions over whether low cost is always the best protection for overall margins and overall revenues.

Are there other ways to build resilience without such a drastic reconfiguration of business models?

Digital must become the default for every business. Volatility is not going away. Keeping a handle on the kind of fluctuations that come with even minor disruptions is simply not scalable manually. Even if you had limitless resources at your disposal you’d still face enormous issues gaining a real-time view of the flow of materials across the supply chain, or collaborating with more than a handful of suppliers.

A majority of businesses seem to accept now the need for digitalization - what has taken them so long?

Businesses have benefited from a very prolonged period of stability. When you have low volatility it’s easy enough to rely on a limited number of people to get the job done. Now that the level of disruption has increased, businesses are finding they cannot simply adjust the number of people they have addressing these issues.

Organizations have not been blind to these risks, but when times are good, other things tend to take priority. The investments businesses have previously sunk into legacy systems also breeds inertia. A lot of businesses made significant investments in EDI systems and supplier portals. That brought them a certain level of digitalization among the top 20% of their supply chains, but that’s still 80% of supplier relationships that are built around manual processes. Adherence to this old paradigm has prevented a lot of businesses from making the next leap. Businesses are recognizing they won’t get to where they need to be by doing a little bit more of what they’ve been doing over the past ten years.

What are some of the things that businesses need to consider as they look to digitize?

Businesses have tended to look at risk from a volume perspective. That means focusing on the biggest suppliers and building connectivity with them first for efficiency reasons. What they really need to be analysing is where the highest level of change might come from. More often than not that will be a smaller supplier somewhere further down the chain.

We also need to move beyond the focus on features and functions. It’s all very well looking for a product that meets a certain set of specifications, but that will count for nothing unless the entire ecosystem is incentivized and willing to adopt the processes. A lot of businesses are too focused on what a product does for them. They need to be zooming out and considering whether suppliers will see an equivalent level of value from adopting the same system and come on board.

Building resilience to unpredictable events can feel a little like buying insurance - you know you need it, but it’s not something you value unless the worst happens. Is that the right way to look at this?

Organizations in the direct procurement space are under mounting pressure to provide a digital footprint that shows they are operating in compliance with regulatory requirements. Take the medical device industry, where there is a very heavy emphasis on traceability through the supply chain. Digital twinning is also becoming more important to maintenance and production cycles. Before we start to talk about these technologies we first need to ensure that the full configuration of inbound material is also digital. If you need to start entering and typing that information manually then the whole process will break down very quickly. Resilience is much more than an insurance policy, it’s becoming a license to operate in the future.

Can you give us some examples of ways in which Quyntess is working with organisations to help them react to changing environments in real-time?

We’re helping a number of organizations to handle forecasting and variations within the supply chain through automation. This means linking real-time data to production plans and inventory so that businesses have an accurate understanding of how fluctuations in demand may impact their ability to continue production.

Shipping is another area where we provide significant support. Even at the best of times the relationship between suppliers, buyers and logistics providers is a delicate dance. When you add fluctuating demand and limited logistics capacity into the mix it becomes very challenging to manage, particularly if the process is partially paper-based. With a network like Tradeshift we replace parallel 1:1 exchanges with suppliers and carriers with an orchestrated three party collaboration which makes the businesses much more nimble and gets things moving.

Finally, and linked to all of this, is risk dashboarding. Increasingly we’re seeing an appetite for more metrics that relate specifically to the vulnerability of a certain supplier to a disruption. The fact that we have those dashboards available on the Tradeshift platform makes it much easier for buyers and suppliers to define and collaborate on contingency plans.

Read more in the full Q2 2021 Global Trade Health Report here.

Share this

You May Also Like

These Related Stories

Maneki-neko “Dear customer, please come in”

Digitization helps turn uncertainty into opportunity